workers comp taxes for employers

For micro businessesmeaning companies with fewer than 10 employersCoverWallet is an excellent option for workers compensation insurance. The name and address of the doctor or hospital that provided your initial treatment.

What Wages Are Subject To Workers Comp Hourly Inc

A human resources management system HRMS or Human Resources Information System HRIS or Human Capital Management HCM is a form of Human Resources HR software that combines a number of systems and processes to ensure the easy management of human resources business processes and data.

. The workers comp system seems. Your HR and Payroll Outsourcing Experts - Protecting Employers from HR Administrative and Regulatory Exposures. They may be paid by federal or state workers compensation agencies employers or by insurance companies on behalf of employers.

Work comp rates for all job classification codes are always expressed as a percentage of 100 in wages. Some industries are exempt from mandatory Workers Compensation insurance. Workers compensation and other public disability benefits however may reduce your SSDI benefits.

Workers Compensation Premium Tax Paid by insurance companies offering workers comp insurance. Whether you have 10 employees or 1000 OmegaComp HR will customize a solution to help decrease HR exposures and increase. RETURN-TO-WORK REIMBURSEMENT PROGRAM FOR EMPLOYERS.

If youre shopping for workers comp you may be wondering who the biggest workers comp insurers are. Sole-Proprietors Partners and LLC Members included on a workers compensation policy must use a minimum payroll amount of 34320 for work comp rating purposes. In Ontario computer programmers private health care practices such as those of doctors and chiropractors private daycares travel agencies photographers and taxidermy are among the exempt industries.

Some employers in order to keep their insurance premiums low or unchanged would prefer to pay for a workers injury rather than report it to the employers workers compensation carrier. Idaho Industrial Commission. On a work week basis this act requires employers to pay a wage of 1 12 times an employees normal pay rate after that employee has completed 40 hours of work for workers 16 and over.

Should you have any questions contact the Workers Compensation Division at 1-800-528-5166 or 334 956-4044. The DWC does not provide workers compensation insurance for employers and does not maintain information about employers and their respective insurers. Human resources software is used by businesses to.

DCWC Form 7A must be filed within one year after injury or death. When deciding whether to opt in or out of workers compensation coverage executive officers and other principals should evaluate other possible sources of benefits. Contact your nearest IIC office for details.

Texas Employers may treat the cost of coverage as an expense on their taxes. Deadlines for New York Workers Comp Claims. Welcome to the website of the Workers Compensation Court of Existing Claims Our goal is to provide information useful to injured workers employers insurers medical providers attorneys taxpayers and other interested parties.

Weekend or night work does not apply for overtime pay unless it is over the mandated 40 hours. The dollar amount of gross wages before taxes and other deductions paid per pay period. Also you dont pay Social Security taxes union dues or retirement fund contributions.

457 Deferred Comp 457 Auto Enrollment Resolution Form 457 Plan Contributions State 457. Make sure your workers compensation coverage is legitimate. Is this practice legal in Massachusetts.

The form can be obtained from the employer insurance carrier or the Office of Workers Compensation. If fees taxes and expenses were reflected the hypothetical. This represents 33 of the 150 million total participants in private employment-based plans nationwide.

An annual policy is always subject to an audit because it was based on. Businesses that fail to carry compulsory workers compensation insurance can face severe fines. You dont pay federal state or local income tax on TD benefits.

In the early 20th century state governments employers and employees made a grand bargain. You May Want Workers Compensation Insurance Even if You Are Exempt. Americas workers compensation system depends on nearly all employees having workers comp insurance.

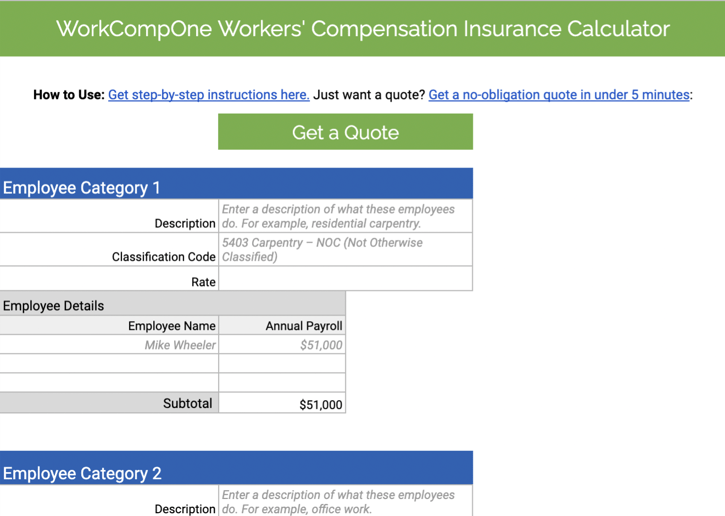

Corporate Officers must utilize a minimum payroll of 34320 and a maximum of 137280 in order to calculate the cost of workers comp insurance. State investigators recently have noted that some employers who purchase workers compensation coverage as part of a bundle of services that may include human resources management payroll services tax filing and insurance administration from professional. Even in industries that are fairly safe small business owners would be mistaken to think workers compensation insurance isnt required.

COLLECTION OF TAX AFTER WITHDRAWAL FROM BUSINESS. Pay for vacations sick days or personal days is not covered. The names and addresses of any other employers you worked for at the time of your injury or illness.

Finally workers compensation insurance provides medical disability and other benefits to injured workers. When a work-related injury needs to be reported Workers Compensation Insurance Rates and Codes Mandatory notice to employees poster Ways to reduce workers compensation insurance costs Workers Compensation Insurance Requirements Who is covered by workers compensation insurance Frequently Asked Questions by Employers The steps in the dispute. Keep a copy of the completed form for your records file a copy with your employer and send the original to the Office of Workers Compensation.

The manner or method by which you choose to insure your workers compensation liability is your decision. Find Out How You Can Join Many of Your Co-Workers on a Journey to a Better Retirement. Examples are health disability and accident insurance.

According to a 2000 report by the Employee Benefit Research Institute EBRI approximately 50 million workers and their dependents receive benefits through self-insured group health plans sponsored by their employers. Self-insured Employer Premium Tax Paid by companies that self-insure workers comp coverage only available to very large corporations. Investment return are not guaranteed and will vary depending on investments and market experience.

This is a common fund into which employers have by agreement pooled their liabilities for the purpose of providing Alabama. Best Tax Software. Workers compensation payments are made to a worker because of a job-related injury or illness.

Department of Industrial Relations. The Texas workers compensation statutes are located in Texas Labor Code Title 5. The benefits of workers compensation.

But certain types of employees as well as some business owners are workers comp exempt. Workers Comp Exemptions in New Jersey.

How Does Workers Compensation Work In Vermont Sabbeth Law

Workers Compensation And Taxes James Scott Farrin

What Is Workers Compensation Article

Pin On Workers Compensation Audit

Permanent Disability Pay In California Workers Comp Cases 2022

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

What S Included In Worker S Compensation For Remote Jobs Gusto

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Workers Compensation Insurance Overview Amtrust Insurance

How Long Can A Workers Comp Claim Stay Open Canal Hr

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Permanent Disability Pay In California Workers Comp Cases 2022

California Businesses May Have To Pay More For Workers Compensation As Benchmark Rates Are Under Review

Fmla Vs Workers Compensation Rules What No One Tells You

Ncci State Map State Map Map Small Business Insurance

Workers Compensation And Taxes James Scott Farrin